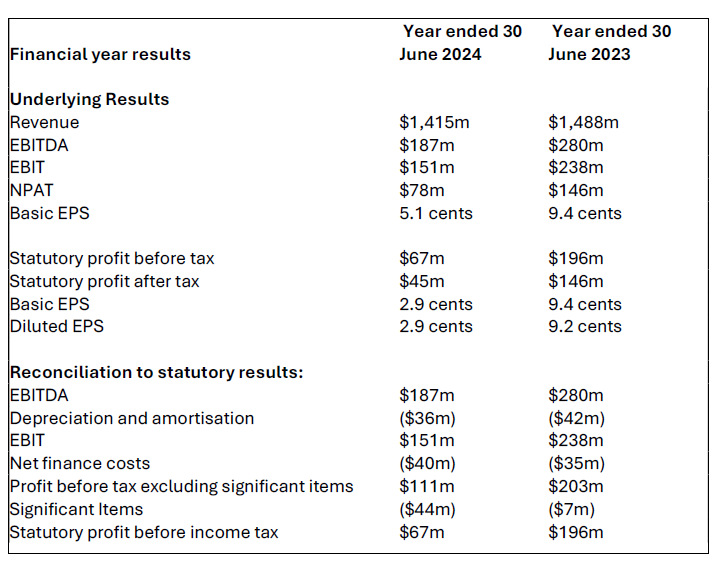

Seven West Media F24 financial results – Seven West Media Limited (ASX: SWM) today released its results for the 12 months ended 30 June 2024.

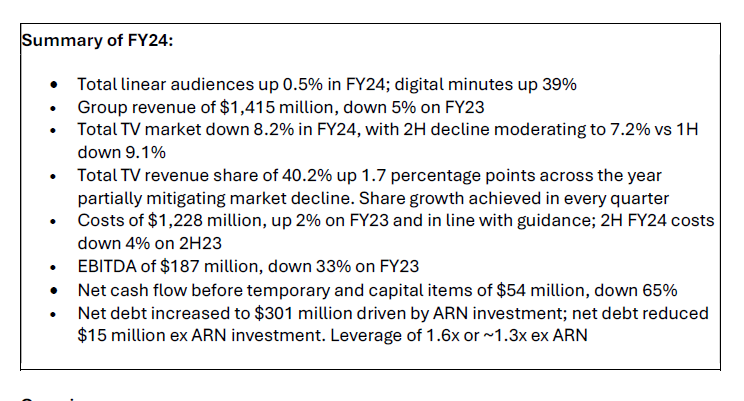

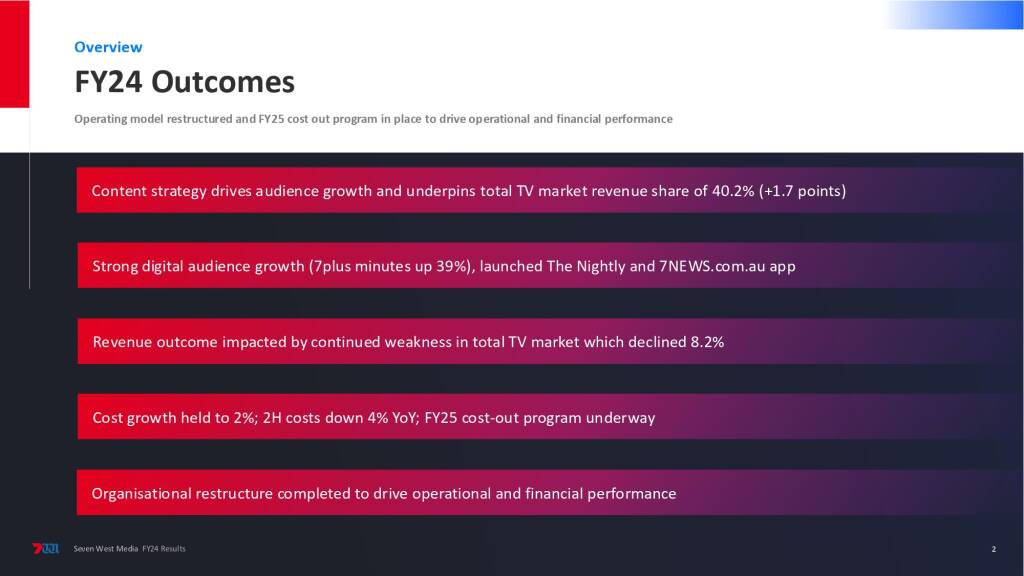

The results reflect the ongoing decline in advertising markets which was partially offset by growth in Seven’s revenue share of the total TV market.

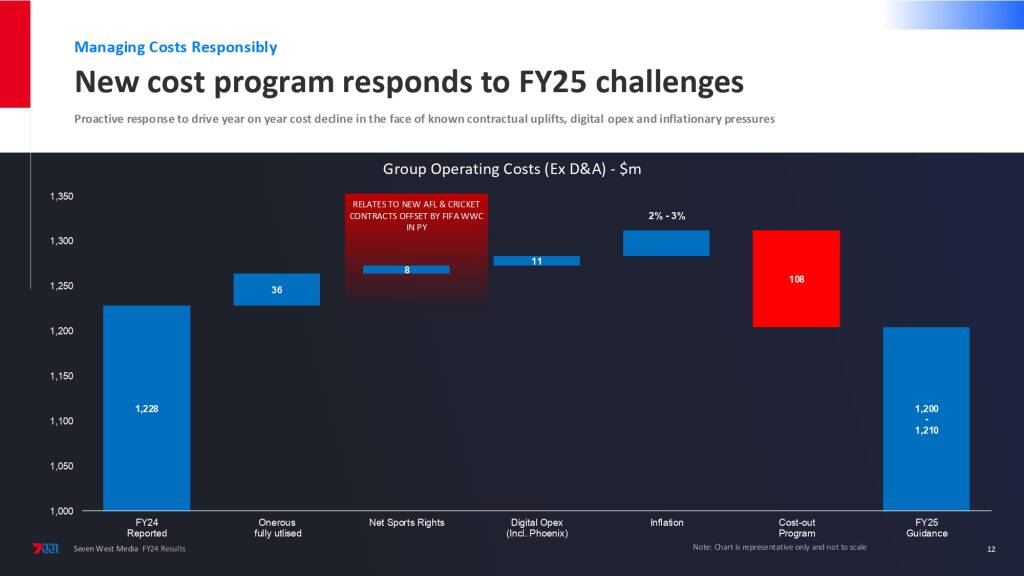

Operating cost growth was held to 2%, in line with guidance. The first phase of the announced cost reduction program delivered $25 million of savings in 2H which saw a 4% decline in costs vs the same period in FY23.

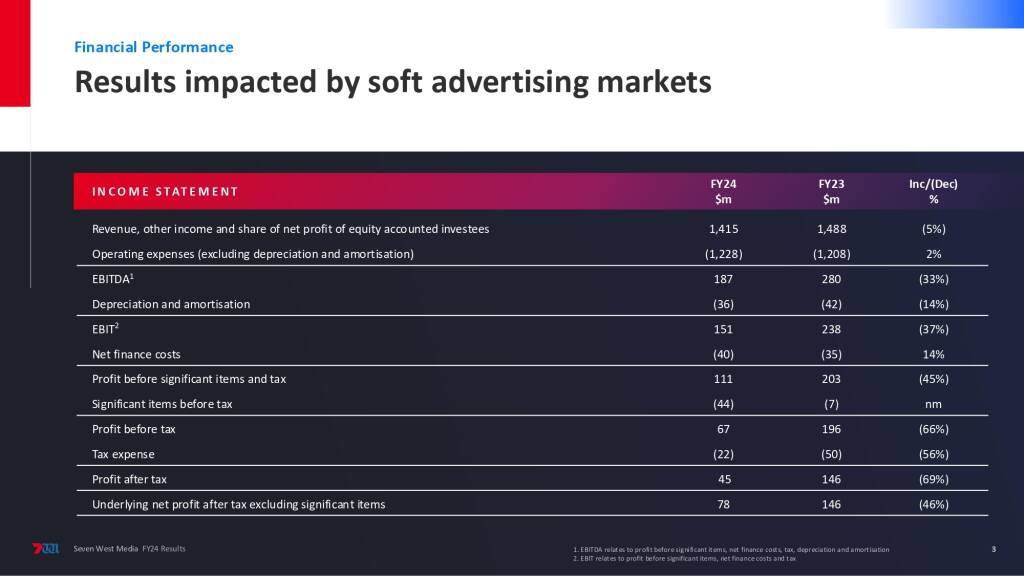

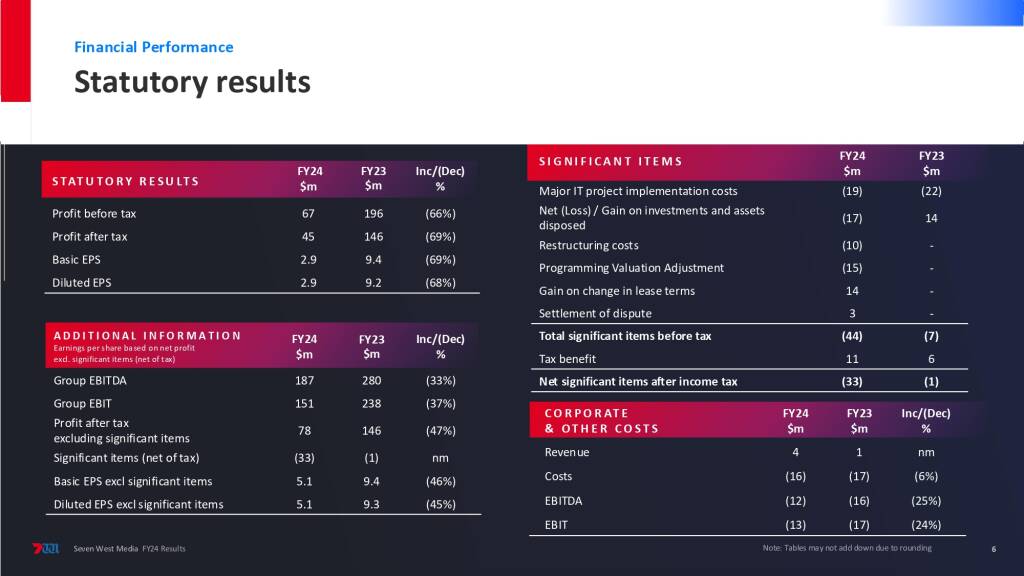

Group revenue of $1,415 million was down 5% ($73 million) on FY23. Statutory net profit after tax of $45 million was down 69% on FY23, while underlying net profit after tax after excluding significant items was $78 million, down 46%. Group EBITDA before significant items of $187 million was down 33% ($93 million) on FY23.

SWM Managing Director and Chief Executive Officer, Jeff Howard, said:

“FY24 is a tough result for SWM in a challenging market. While growth in audience and revenue share partially offset the impact of the weak market, cost growth of 2% contributed to our EBITDA decline of 33%, reflecting the operating leverage in our business. Following delivery of $25 million of cost out initiatives in 2H, we have taken decisive action to materially increase the program into FY25 to give SWM a platform to drive improved performance.

“The continued weak economic environment contributed to an 8.2% decline in the total TV advertising market on FY23. SWM was able to partially offset this decline by increasing our revenue share of the total TV market to 40.2%. This share growth was built on the targeted content investments made. The Group was able to partially offset these investments through the implementation of $25 million of cost reductions in the 2H under the program announced at the FY23 AGM.

“SWM continues to deliver market leading content across our linear and digital platforms that engaged and grew audiences during FY24. We achieved solid growth in our BVOD audience during the year, but we are still to fully capture the revenue opportunity.

“We are committed to driving improved profit and cash flow irrespective of market conditions. Despite the advertising environment, we are focusing on capturing a greater proportion of available dollars in each market including a step change in our digital revenue performance. FY25 revenue will include the benefit of digital rights under the new cricket and AFL sport contracts. We have also implemented an enhanced cost out program that will deliver a year-on-year decline in costs in FY25.”

Total Television

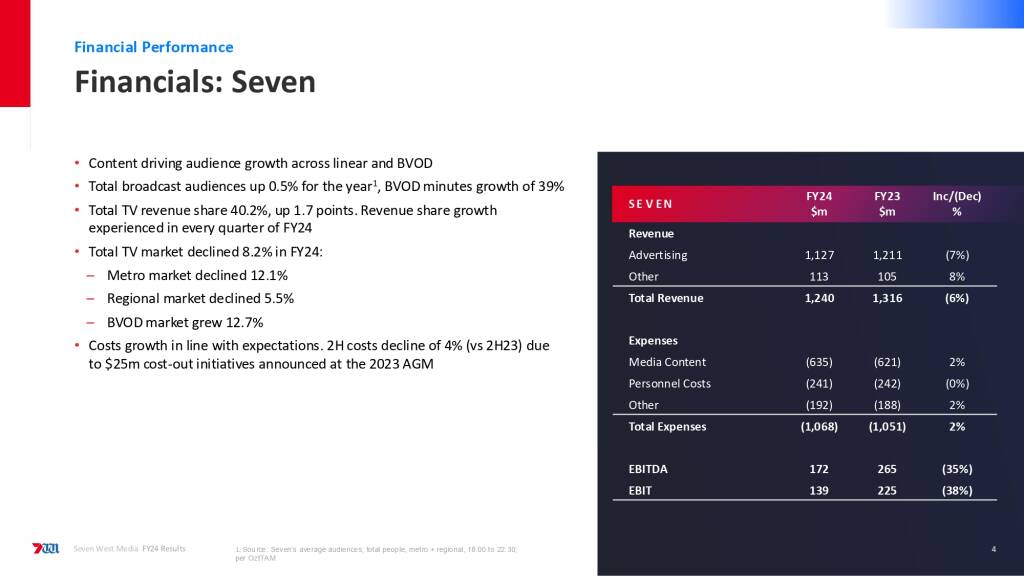

Every month, Seven Network reaches more than 17 million people nationally across television and digital. Seven’s content continues to resonate with audiences, with linear audience growth of 0.5%1 and BVOD minutes growth of 39% across the financial year.

Seven retained its position as the number one network for national audience share for the fourth year running in FY24.

The total TV advertising market declined by 8.2% in FY24 including a decline in metropolitan markets of 12.1% and 5.5% in regional markets, offset by an increase in the BVOD market which grew 12.7%. After a 9.1% market decline in 1H, the rate of decline moderated to 7.2% in 2H.

Seven delivered a 40.2% revenue share of the total TV market, a gain of 1.7 share points. Gains of at least 1.4 percentage points were achieved across each quarter of the year. Share growth was achieved in each of the metropolitan, regional and digital markets.

Seven’s TV revenue declined by 6% during the year to $1,240 million, largely reflecting a 7% decline in advertising revenue to $1,127 million and an 8% increase in other revenue (which includes international program sales) to $113 million.

Costs of $1,068 million were 2% higher than FY23 driven primarily by increases in content (entertainment and tentpole programming) offset by a year-on-year decline in sport costs based on major events in the prior year. In 2H, costs were down 4% year-onyear to $498 million in line with guidance provided at the 1H FY24 result.

Total TV EBITDA declined by 35% to $172 million, reflecting the impact of lower revenue and higher costs. EBITDA in 2H was down 19% on the previous corresponding period, reflecting moderation in the rate of revenue decline, partially offset by share growth and the cost outcome achieved in the half.

The West

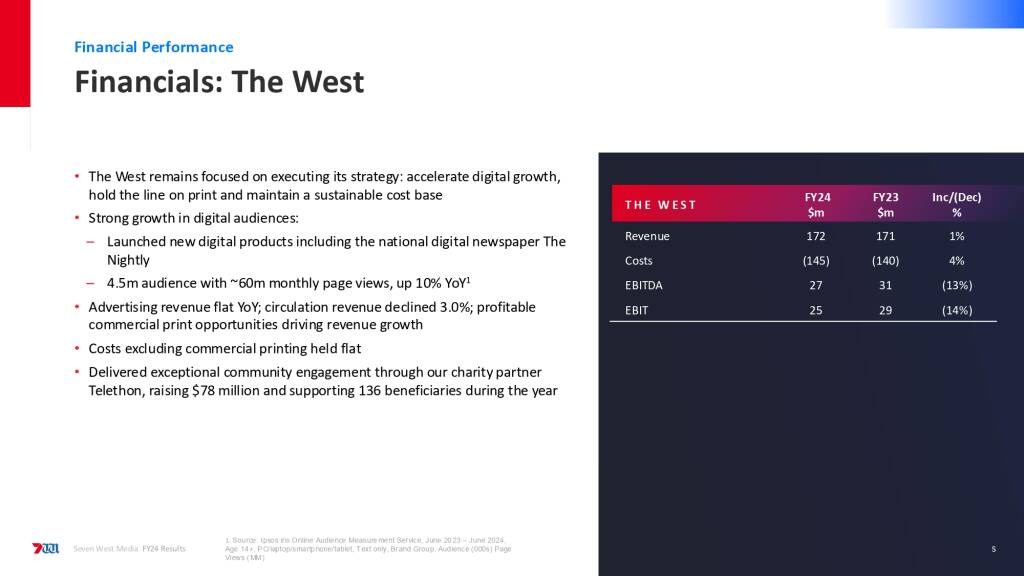

The West performed solidly, with headwinds in traditional print media offset by digital growth and commercial print opportunities. The West’s digital platforms now have a collective audience of 4.54 million and generated 59.5 million monthly page views, an increase of 5.2 million page views or 9.6% year-on-year.

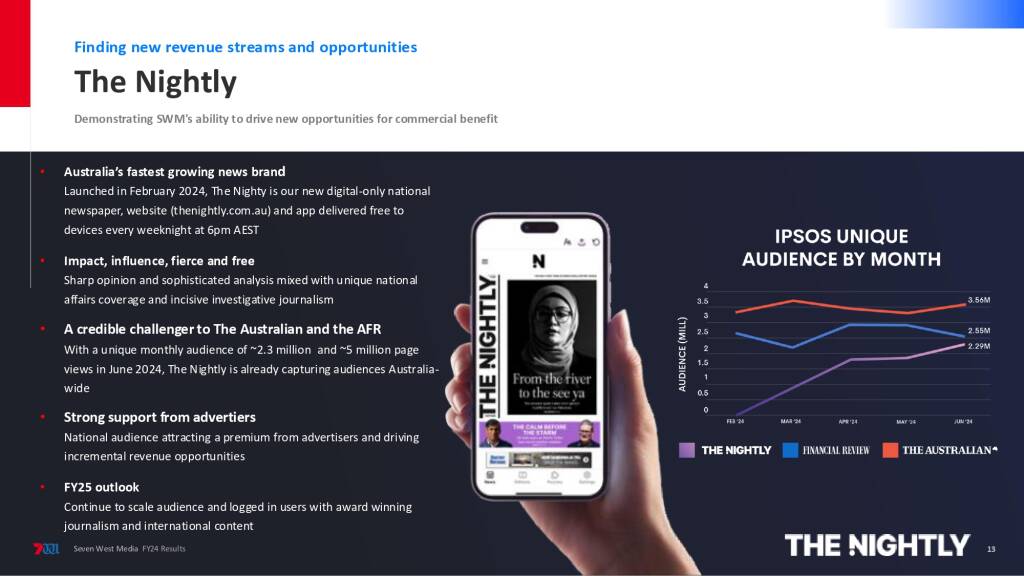

Revenue of $172 million was broadly flat on FY23 driven by commercial printing as well as new sources of digital advertising, including the successful launch of The Nightly.

The Nightly is a national digital newspaper, website and app which has quickly grown to unique monthly audience of ~2.3 million and ~ 5 million page views in June 2024. The West’s advertising revenue was flat year-on-year and circulation revenue declined 3.0%.

Cost growth was limited to 4%, with the increase reflecting higher labour, material and printing costs associated with new commercial printing work secured, new digital products and CPI increases. Like-for-like costs have been held flat.

The West EBITDA of $27 million was down 13% on FY23.

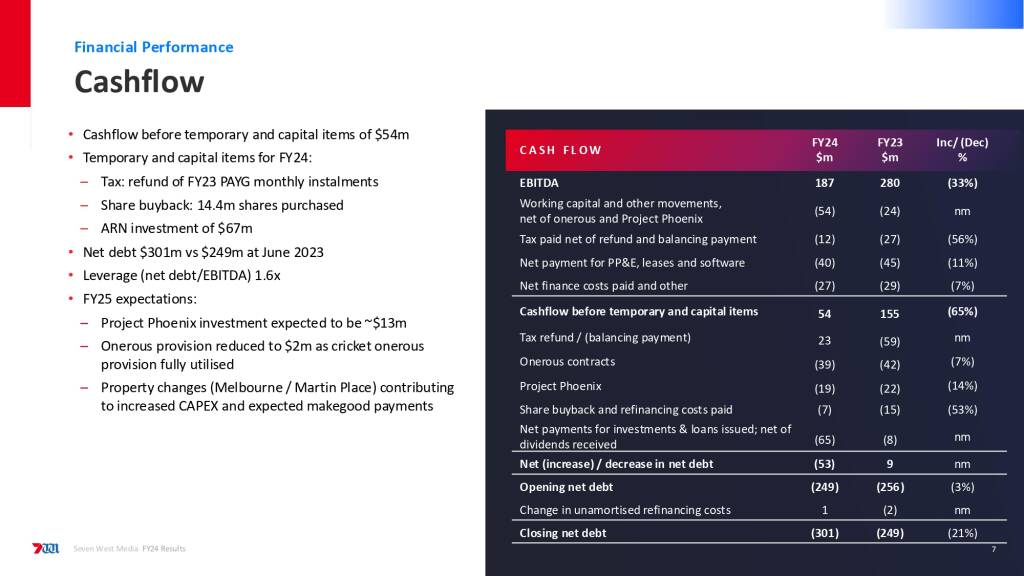

Balance Sheet, Cash and Capital Management

Net debt of $301 million increased from $249 million as of 30 June 2023. Cash flow before temporary and capital items was $54 million. Temporary items relate to cash outflows of $58 million in relation to Project Phoenix and onerous contracts, offset by a tax refund received, and $67 million was invested in the purchase of ARN Media Limited shares in November 2023.

Net leverage (net debt/EBITDA) increased to 1.6x from 0.9x as at 30 June 2023 and 1.3x on 31 December. Leverage adjusting for the ARN investment is 1.3x.

During the year, $4 million of shares were repurchased. The Board will not renew the buyback in FY25 given the ongoing uncertainty in advertising markets and no dividend will be paid in respect of the FY24 year.

New Operating Model and Efficiency Program

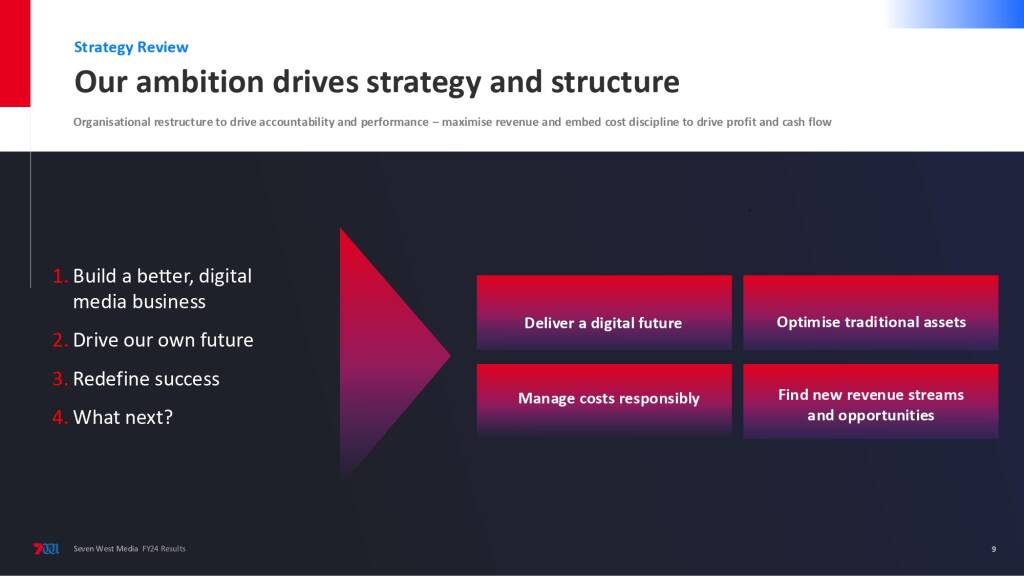

In June 2024, SWM announced a new operating model for FY25 designed to support a refreshed strategy to ensure SWM meets the challenges and opportunities of the changing media landscape.

Under the new model, SWM will comprise three divisions: television, digital and The West. While each division will operate as an accountable and transparent profit centre, they will work collaboratively to drive Group revenue, productivity and cost efficiency outcomes.

The new structure will improve SWM’s ability to deliver its digital future which to date has underperformed revenue expectations. New leadership will have full control of the total digital value chain, from audience acquisition, engagement and content strategy.

They will also ensure our go-to market strategies position SWM to fully address the revenue growth opportunity in the BVOD and broader digital advertising market.

The television business will be focused on maximising revenue, earnings and cash flow notwithstanding advertising market conditions through disciplined cost control, to ensure maximum operating leverage when market conditions improve.

The West continues to demonstrate the benefits of this empowerment and accountability in holding performance in the face of structural and cyclical headwinds while developing digital initiatives to create new revenue and profit opportunities.

Mr Howard said:

“Our new operating model establishes clear accountability for driving our own financial destiny. We will build a better and more resilient media business that captures the clear opportunity in digital and maximises the financial returns in our traditional businesses. The change in structure and leadership allows us to leverage skills across the business and to embed a performance culture.

“SWM connects with more Australians than nearly any other media company. We must embrace the challenge to drive a greater share of advertising dollars in each of our markets while committing to a culture of cost discipline across the business. Our aspiration is to generate solid margins, profit and cash flow through the cycle.”

As a part of the new operating structure, and in line with SWM’s commitment to maintain discipline on costs, the cost and efficiency program which commenced in the FY24 year has been increased to address various contractual and inflationary cost increases and the continuation of an uncertain advertising market in FY25.

The cost out program will see costs decline in FY25 to a range of $1,200 million to $1,210 million. The targeted cost out program of $108 million includes the already announced $35 million remaining under the previous program.

Outlook and Priorities

Trading update:

Olympics contributing to TV market growth for July and August; Seven’s share impacted as expected.

September and October bookings currently down 4 – 5% vs same time last year

Expecting revenue share gains in FY25 from digital sports rights (November onwards); Cricket bookings tracking up 11% vs same time last year

Full year costs expected to be ~$20-30m lower than FY24 based on benefits identified to date

Media Release – Seven

Link to 7plus HERE

TV Central Seven content HERE

Seven West Media F24 financial results