Seven West Media 2025 full year financial results – Seven West Media Limited (ASX: SWM) today released its results for the 12 months ended 30 June 2025. The results reflect the execution of the strategy to kickstart growth.

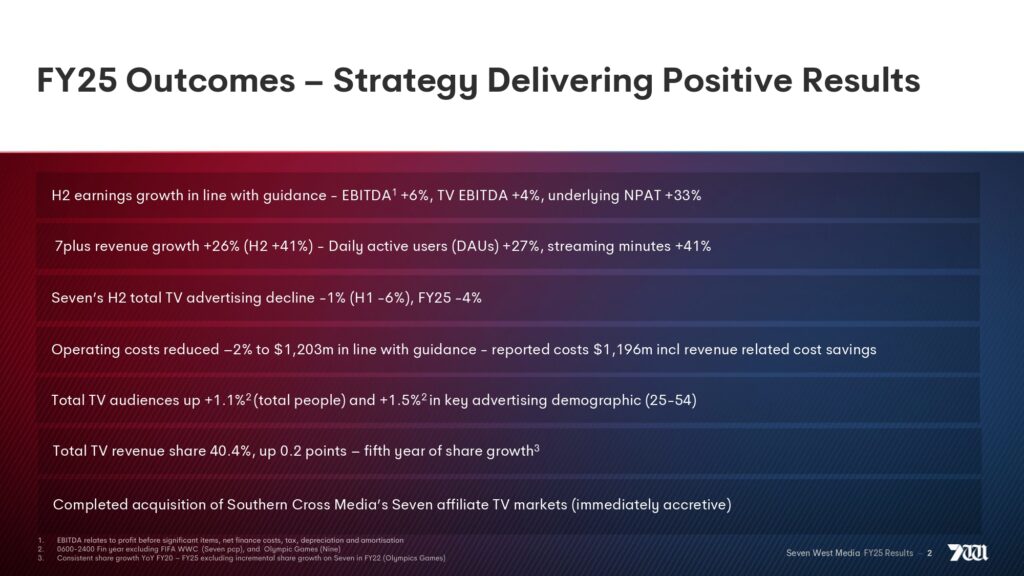

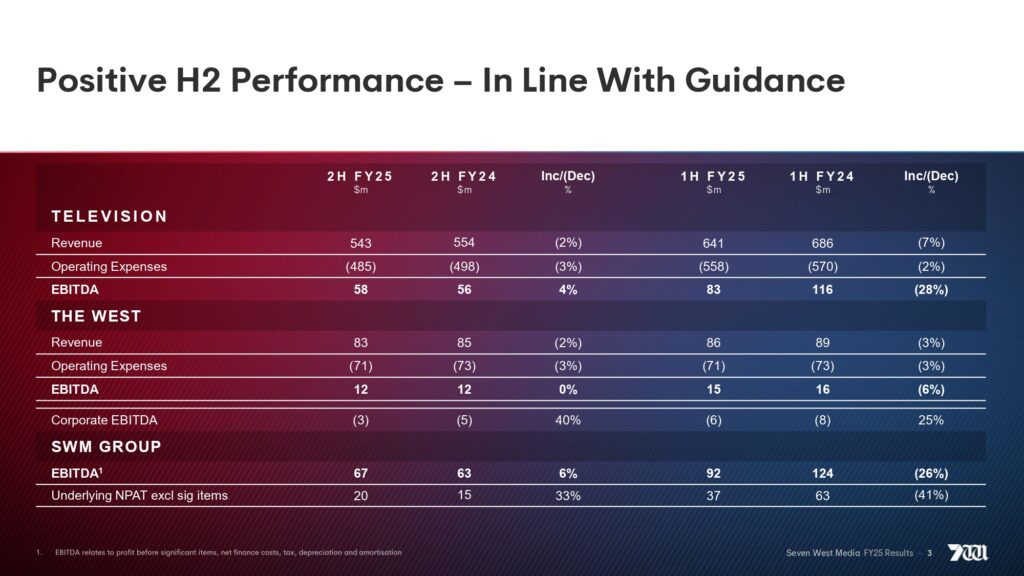

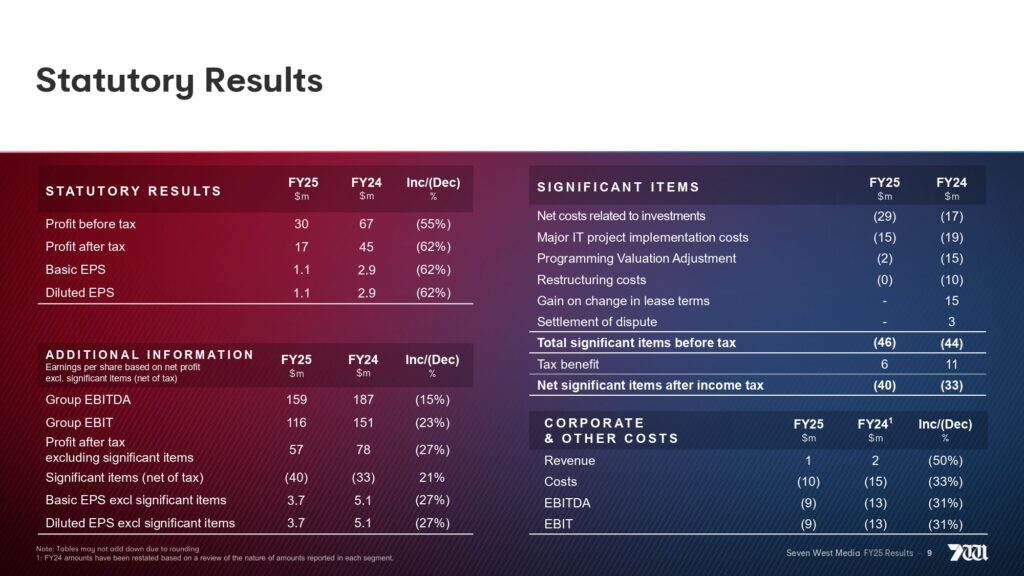

SWM delivered second half EBITDA growth of +6% and second half underlying NPAT growth of +33% in line with guidance provided in February 2025, which is the first half yearly growth outcome since FY22. Group operating costs of $1,203 million were also in line with guidance.

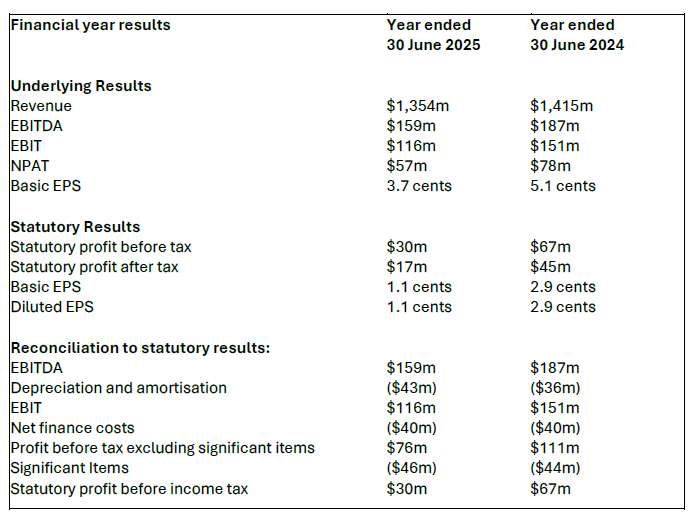

Group revenue of $1,354 million was down -4% ($61 million) on FY24 with the rate of decline moderating in the second half to -2%.

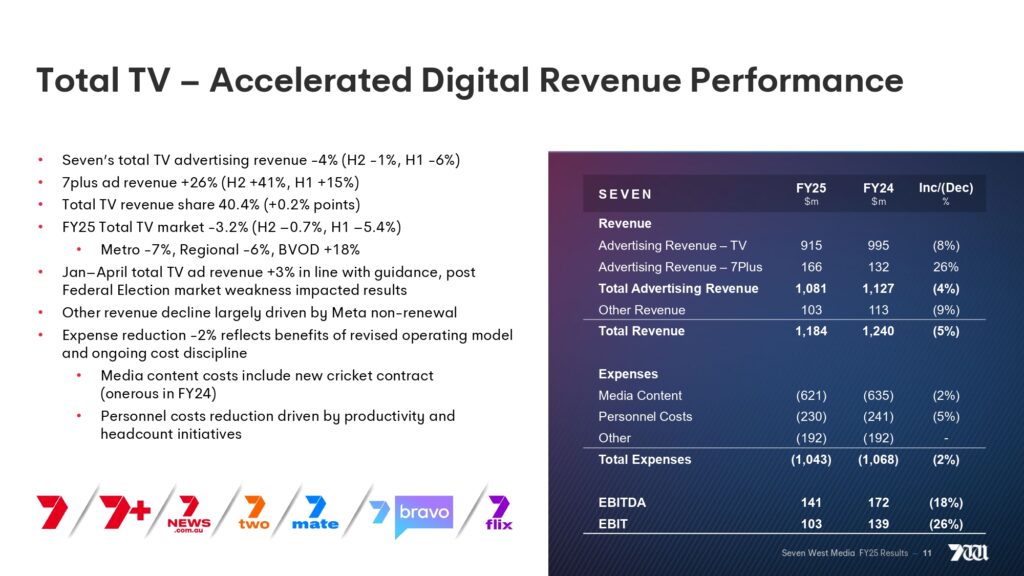

Seven’s total TV advertising revenue was down only -1% in the second half, driven by a +41% increase in 7plus revenue. This compares favourably to the first half revenue decline of -6%, when 7plus revenue grew +15%. January to April 2025 total TV revenue grew by low single digits, in line with the February outlook, however, the post Federal Election market was weaker than anticipated. Cost actions were undertaken to mitigate this revenue decline.

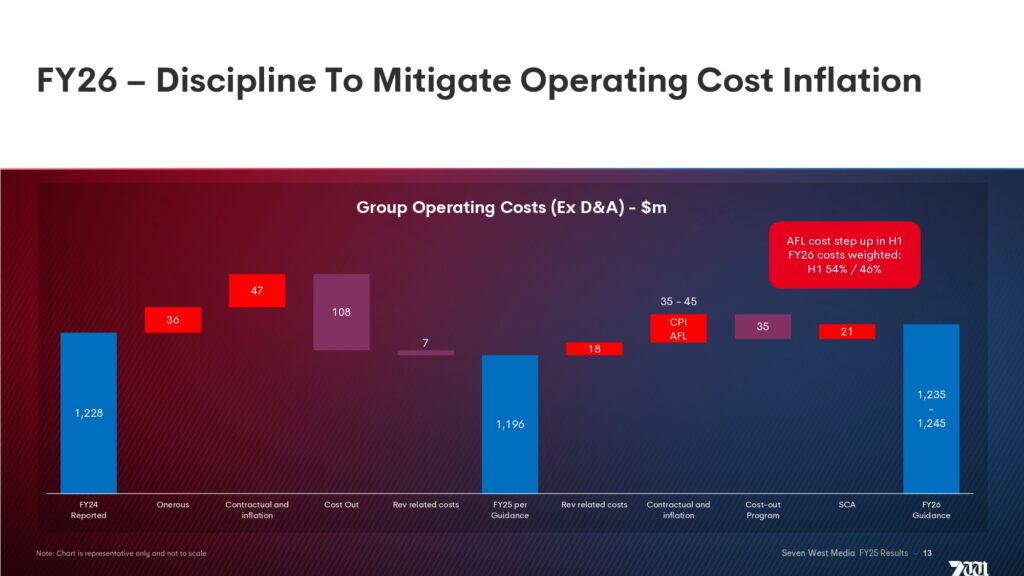

Underlying operating costs of $1,203 million were -2% lower than in FY24 and within guidance. Reported costs of $1,196 million reflect $7 million of cost savings largely attributable to the late second half revenue decline.

Group EBITDA (pre significant items) of $159 million were down $28 million (-15%) on FY24. Statutory NPAT was $17 million, down $28 million (-62%), and underlying NPAT of $57 million was down $21 million (-27%).

SWM Managing Director and Chief Executive Officer, Jeff Howard, said:

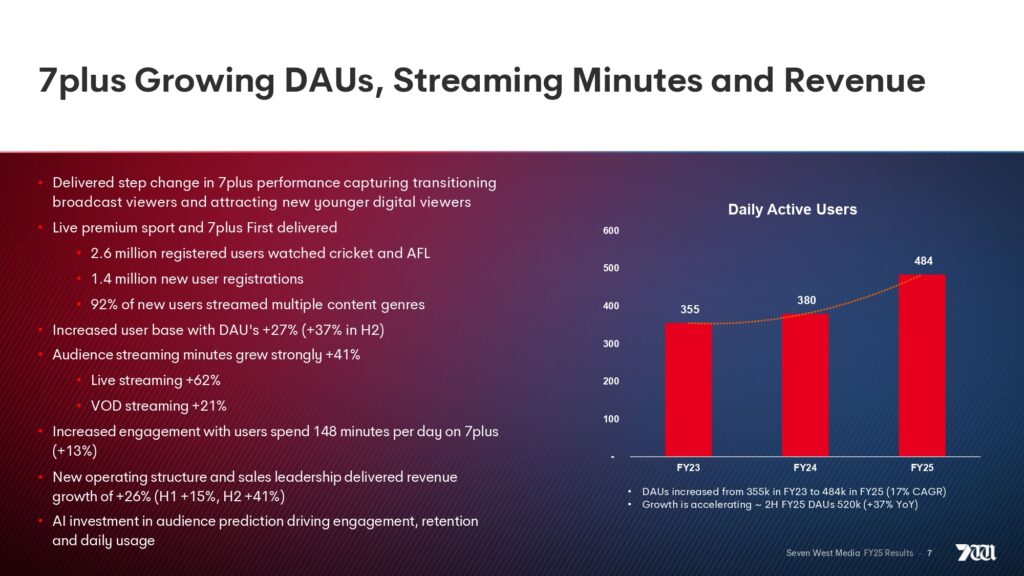

“FY25 has seen Seven West Media make solid progress under our new structure to kickstart growth, in line with our strategic plan. It is pleasing to report that we delivered earnings growth in the second half in line with our guidance. This improved performance mainly reflects the step change in 7plus audience and revenue, which is on the verge of offsetting the revenue decline in broadcast TV.

“Our investment in digital content including premium live sport and 7plus First programming has driven strong results for 7plus. We saw +27% growth in daily active users and +41% growth in streaming minutes over the year, which translated to digital revenue growth of +26%. Revenue growth accelerated in the second half, up +41%.

“The growth in our total TV audiences highlights that our content is resonating with viewers. In addition to strong growth in streaming minutes for our VOD library on 7plus, we continue to see strong engagement across all programming including 7NEWS, Sunrise, The Morning Show, our live and free AFL, Test and Big Bash League cricket coverage, and our entertainment programming including Home and Away, Australian Idol, The Voice, The 1% Club, Farmer Wants A Wife, Dancing With The Stars and My Kitchen Rules.

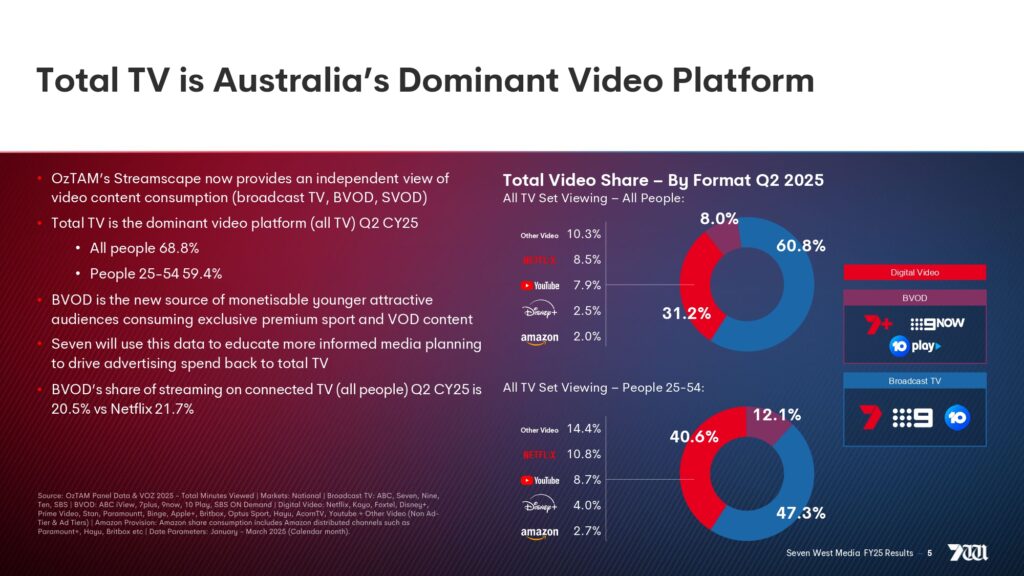

“The recent launch of Streamscape data by OzTAM reconfirms that total TV remains the dominant video platform for advertisers to connect with both targeted and mass audiences. The independent data covers video consumption for broadcast, BVOD, AVOD and SVOD, and is the foundation for Seven to drive more informed media planning and recapture advertising spend for our platforms.

“SWM successfully executed our expense reduction plan in line with guidance, achieving a -2% reduction in costs over the year. We continue to drive productivity and efficiencies without compromising content or editorial quality. FY26 will see a step up in AFL costs as well as incremental costs from the acquisition of Southern Cross Media’s regional TV assets. These assets deliver immediate earnings accretion.

“The West continues to deliver a consistent performance, balancing volatile advertising markets with innovation and efficiency. The Nightly, our national digital newspaper, grew its monthly page views by +60% during the year based on its strong editorial content.

Seven Television

Every month, Seven Network reaches more than 17 million people nationally across the Seven broadcast signals and 7plus. Seven’s total TV audience was up 1.1%2 and +1.5% in the key 25-54 demographic. This includes +41% growth on 7plus (live streaming +62% and video on demand +21%), offsetting a modest -2% decline in broadcast.

Seven’s total revenue declined by -5% during the period to $1,184 million. Total TV advertising revenue fell $46 million to $1,081 million, reflecting the -3.2% decline in the advertising market. Broadcast advertising revenue declined by $80 million (-8%) to $915 million, while 7plus advertising revenue increased by $34 million (+26%) to $166 million. The decline in other TV revenue reflects the non-renewal of the Meta agreement from FY24.

The decline in the total TV advertising market of -3.2% was made up of declines in metropolitan markets of -7.0% and -5.8% in regional markets, offset by an increase in the BVOD market, which grew +18.9%.

Seven increased its total TV revenue share by 0.2 points to 40.4%, with FY25 the fifth consecutive year 3 of growth.

TV operating expenses of $1,043 million were $25 million (-2%) lower than FY24. Media content costs were reduced by -2%, notwithstanding higher contracted sports costs (and the prior year benefit of $36 million from the onerous cricket provision relating to the previous contract term). Personnel costs declined -5% reflecting productivity and headcount initiatives under the revised operating model announced in June 2024.

TV EBITDA of $141 million and EBIT of $103 million declined by -18% and -26% respectively.

The West

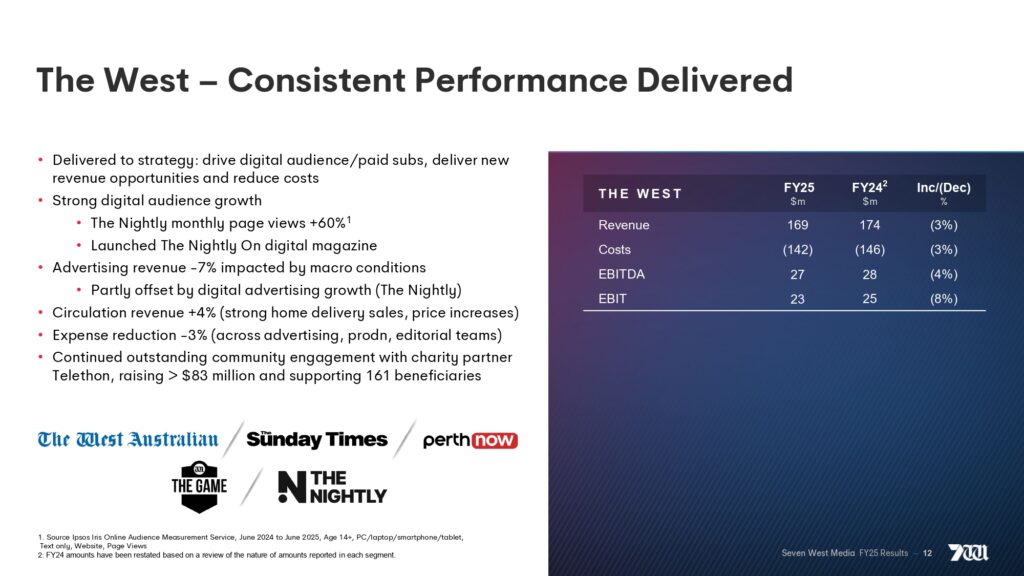

The West held EBITDA broadly flat compared to FY24 at $27 million, reflecting strong execution on strategy by growing digital audiences and paid subscribers, leaning into print products, reducing costs and delivering new revenue opportunities. The West’s digital platforms achieved 54.5 million monthly page views, an increase of +4.4%. The Nightly, launched only 18 months ago, significantly increased page views by +60%.

Revenue of $169 million declined -3% reflecting an advertising revenue decline of -7% partly offset by a +4% increase in circulation revenue.

Costs of $142 million were down -3%, driven by tight cost control and efficiency improvements across advertising, production and editorial teams.

Balance Sheet, Cash and Capital Management

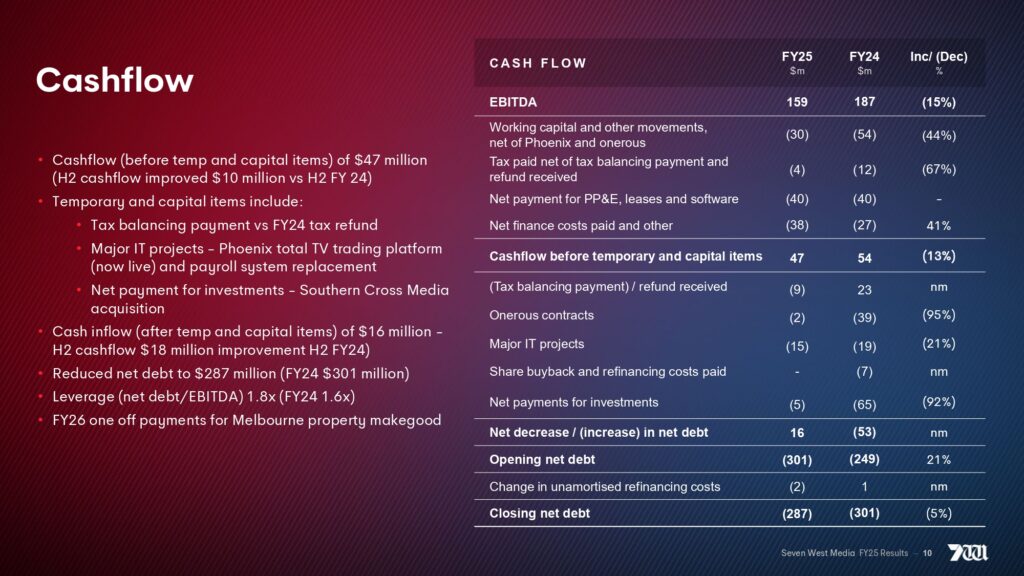

Net debt of $287 million declined from $301 million at 30 June 2024. Cashflow before temporary and capital items was $47 million. Temporary outflow items included the Phoenix total TV trading platform and other IT projects ($15 million) and $9 million prior year tax balancing item. Net payment for investments included $3.75 million for the Southern Cross Media acquisition.

Net leverage (net debt/EBITDA) increased to 1.8x from 1.6x at 30 June 2024.

The Board declared that no dividend will be paid in respect of FY25.

Outlook and Priorities

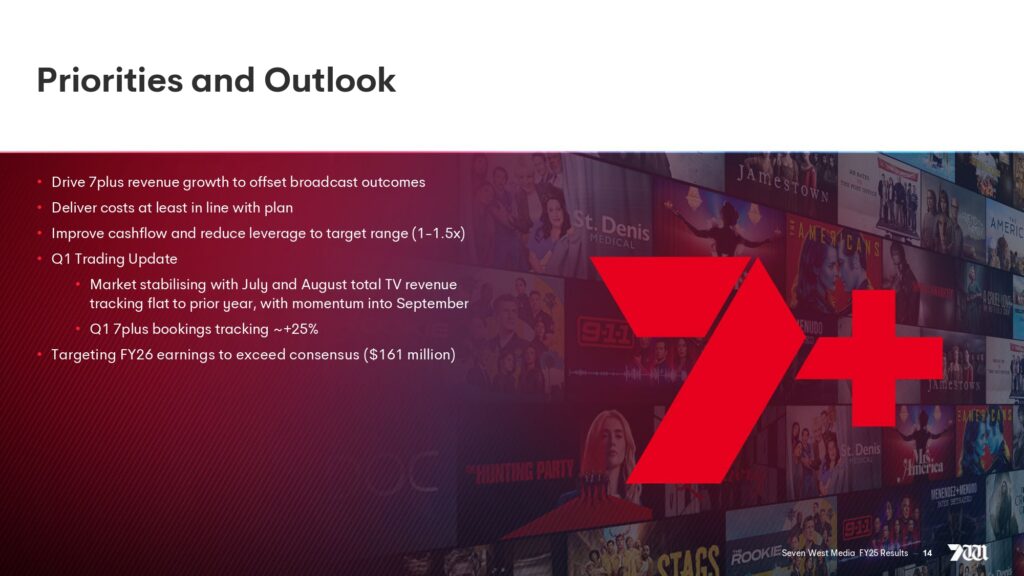

- Drive 7plus revenue growth to offset broadcast outcomes

- Deliver costs at least in line with plan

- Improve cashflow and reduce leverage to target range (1-1.5x)

- Q1 trading update

- Market stabilising with July and August total; TV revenue tracking flat to prior year with momentum into September

- Q1 7plus bookings tracking ~+25%

- Targeting FY26 earnings to exceed consensus ($161 million)

Media Release – Seven

Link to 7plus HERE

TV Central Seven content HERE

Seven West Media 2025 full year financial results